Meet Your Massachusetts Mortgage Lender Team

Who We Are: Your Trusted Boston Mortgage Lender

As a full-service financial institution in the heart of Massachusetts, Fairway Independent Mortgage stands out as one of the best mortgage lenders in Boston. Our company offers a wide range of mortgage loan products, including options for first-time homebuyers, FHA loans, conventional loans, and VA loans.

Whether you’re looking to buy a home or refinance your current mortgage, our team of experts is dedicated to finding the best mortgage solution for you. With our vast variety of home loan options, from fixed-rate mortgages to jumbo loans, and our commitment to customer reviews and satisfaction, we are the mortgage company you can trust for your financial needs. Our pre-qualification process is straightforward, ensuring that you may be able to secure the best loan for your situation, be it a 30-year mortgage, home equity lines of credit, or cash-out options.

Your Trusted Partner in Home Financing

We love our customers.

Customer service is our top priority. We are dedicated to finding the best mortgage rates for you and offer some of the fastest turn times in the mortgage industry but don’t just take our word for it…

I recommended James to assist one of my first time home buyers and he exceeded our expectations. His expertise and market knowledge resulted in tailored mortgage options that fit their needs perfectly. His communication throughout the process was outstanding and kept us consistently informed where we never needed to wonder if the process was on track. I will continue to recommend him to my clients.

I recommended James to assist one of my first time home buyers and he exceeded our expectations. His expertise and market knowledge resulted in tailored mortgage options that fit their needs perfectly. His communication throughout the process was outstanding and kept us consistently informed where we never needed to wonder if the process was on track. I will continue to recommend him to my clients.

I recommended James to assist one of my first time home buyers and he exceeded our expectations. His expertise and market knowledge resulted in tailored mortgage options that fit their needs perfectly. His communication throughout the process was outstanding and kept us consistently informed where we never needed to wonder if the process was on track. I will continue to recommend him to my clients.

I recommended James to assist one of my first time home buyers and he exceeded our expectations. His expertise and market knowledge resulted in tailored mortgage options that fit their needs perfectly. His communication throughout the process was outstanding and kept us consistently informed where we never needed to wonder if the process was on track. I will continue to recommend him to my clients.

I recommended James to assist one of my first time home buyers and he exceeded our expectations. His expertise and market knowledge resulted in tailored mortgage options that fit their needs perfectly. His communication throughout the process was outstanding and kept us consistently informed where we never needed to wonder if the process was on track. I will continue to recommend him to my clients.

Find Out Answers Here

Conventional mortgages hold the title as the most popular type, with lenders originating more than 4.1 million conventional loans in 2022. This contrasts with over 1.3 million nonconventional mortgage originations, including FHA, VA, and USDA mortgages, highlighting the diverse needs of homebuyers.

VA loans often feature the lowest interest rates, benefiting from the support of the Department of Veterans Affairs. However, FHA mortgages also offer competitive rates, particularly for those with less-than-perfect credit histories. Ultimately, securing the best rates depends on various factors, including credit score, debt-to-income ratio, property type (single-family home, condo, or multi-family and down payment size.

FHA mortgages are generally considered the easiest to qualify for, designed to assist those with lower incomes or less-than-ideal FICO scores. If you’re finding it challenging to qualify for a conventional mortgage, an FHA loan could be a viable path to homeownership.

Many first-time homebuyer programs allow buyers who haven’t owned a property in the past three years. This includes divorced spouses who have only jointly owned a home with an ex-spouse.

Choosing the best mortgage lender will depend on the home loan options you’re applying for, how much you want to borrow, the term of the loan, mortgage interest rate, and many other factors. Review our guides for best mortgage lenders, top FHA lenders, and best VA lenders.

Choosing the right mortgage is a significant decision that will impact your finances for years to come. Whether you’re considering a loan backed by the U.S. Department of Veterans Affairs to take advantage of lower mortgage rates without the need for upfront mortgage insurance or exploring a USDA mortgage to purchase a home in a rural area, tools like a mortgage calculator can be invaluable. They help you understand the total loan cost, including the life of your loan and potential higher monthly payments. Remember, making a down payment can reduce your monthly obligations and increase the equity in your home from the start. Ultimately, the best path forward involves careful consideration of your ability to qualify for a mortgage, the type of loan that suits your financial situation, and how long you plan to stay in your home, ensuring you select the mortgage that aligns with your long-term goals.

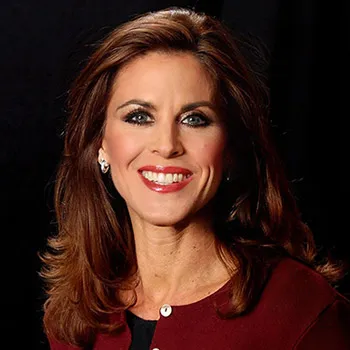

Professional Team